Futures Market: Overnight, LME copper opened at $9,668/mt, hitting a high of $9,694.5/mt shortly after the opening bell. It then fluctuated downward throughout the session, touching a low of $9,648/mt near the close, and eventually settled at $9,650.5/mt, down 0.2%. Trading volume reached 13,000 lots, and open interest stood at 291,000 lots. Overnight, the most-traded SHFE copper 2507 contract opened at 78,640 yuan/mt, hitting a high of 78,700 yuan/mt shortly after the opening bell. It then fluctuated downward, touching a low of 78,500 yuan/mt during the session, and eventually settled at 78,610 yuan/mt after fluctuating rangebound near the close, down 0.01%. Trading volume reached 19,000 lots, and open interest stood at 181,000 lots.

[SMM Copper Morning Meeting Summary] News: (1) China Nonferrous Mining Corporation Limited (01258) announced that on June 16, SM Minerals entered into a subscription agreement with AM shareholders, under which SM Minerals agreed to issue and allot subscription shares, and the company agreed to subscribe for such shares at the subscription price. The company paid the subscription price by way of share subscription, acquiring a 10.5% stake in the issued share capital of SM Minerals. The subscription price will be mainly used for technical exploration and development work at the Benkala Mining Project. This strategy helps to reduce investment risks and effectively utilize the resources and expertise of SM Minerals.

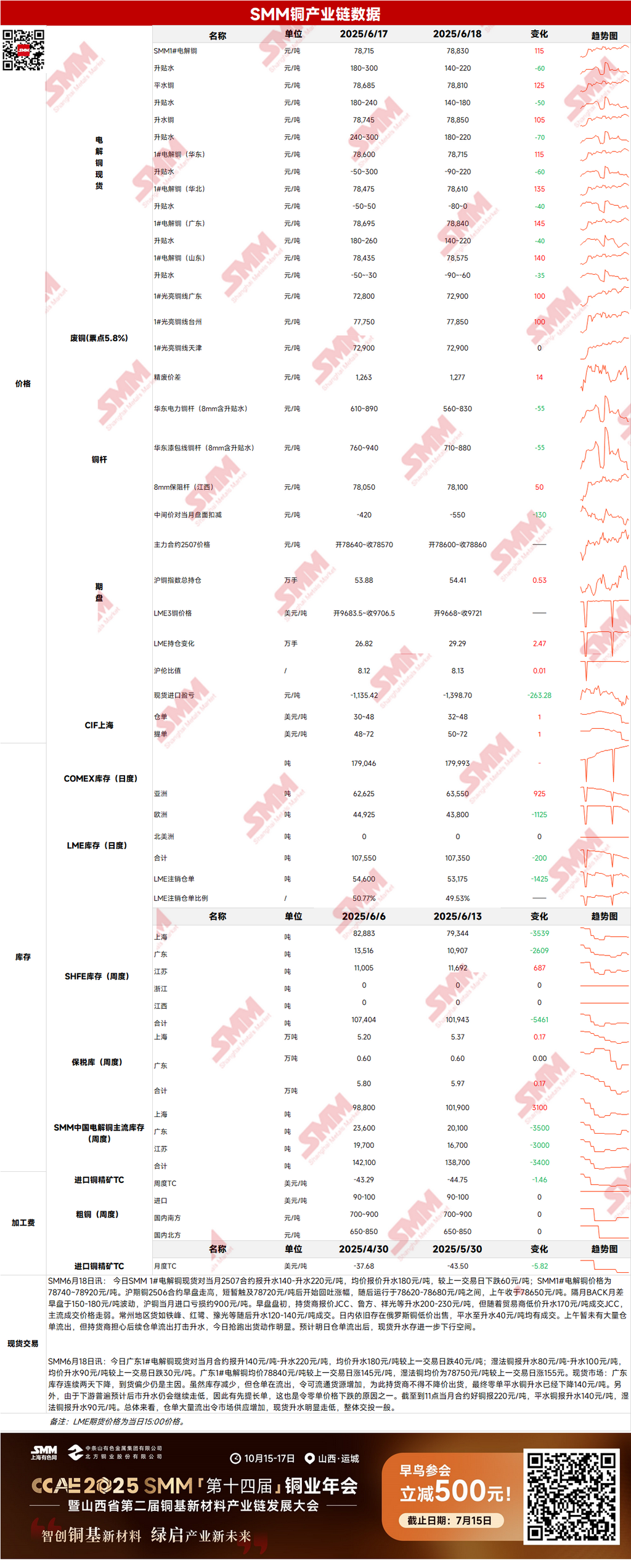

Spot: (1) Shanghai: On June 18, SMM #1 copper cathode spot premiums against the front-month 2507 contract were reported at 140-220 yuan/mt, with an average premium of 180 yuan/mt, down 60 yuan/mt from the previous trading day. The SMM #1 copper cathode price was 78,740-78,920 yuan/mt. The SHFE copper 2506 contract rose in the morning session, briefly touching 78,720 yuan/mt before giving up gains, and then traded between 78,620-78,680 yuan/mt, closing at 78,650 yuan/mt in the morning. The BACK price spread between futures contracts fluctuated between 150-180 yuan/mt in the morning session, with an import loss of about 900 yuan/mt for SHFE copper front-month contracts. No significant warrant outflows were observed in the morning, but suppliers were concerned that subsequent warrant outflows would pressure premiums, leading to obvious selling actions today. It is expected that spot premiums will have further downside room after warrant outflows tomorrow.

(2) Guangdong: On June 18, Guangdong #1 copper cathode spot premiums against the front-month contract were reported at 140-220 yuan/mt, with an average premium of 180 yuan/mt, down 40 yuan/mt from the previous trading day. SX-EW copper premiums were reported at 80-100 yuan/mt, with an average premium of 90 yuan/mt, down 30 yuan/mt from the previous trading day. The average price of Guangdong #1 copper cathode was 78,840 yuan/mt, up 145 yuan/mt from the previous trading day, and the average price of SX-EW copper was 78,750 yuan/mt, up 155 yuan/mt from the previous trading day. Overall, significant warrant outflows increased market supply, leading to a notable decline in spot premiums, and overall trading was moderate.

(3) Imported Copper: On June 18, warrant prices ranged from $32 to $48/mt for QP July, with the average price increasing by $1/mt from the previous trading day. B/L prices ranged from $50 to $72/mt for QP July, with the average price also increasing by $1/mt from the previous trading day. EQ copper (CIF B/L) prices ranged from $4 to $18/mt for QP July, with the average price remaining unchanged from the previous trading day. Quotations were based on cargo arrivals in late June and early July. Overall, a large volume of domestic warrants and B/Ls remained difficult to trade, with weak purchase willingness from downstream buyers.

(4) Secondary Copper: On June 18, the price of secondary copper raw materials increased by 100 yuan/mt MoM. In Guangdong, the price of bare bright copper ranged from 72,800 to 73,000 yuan/mt, up 100 yuan/mt from the previous trading day. The price difference between copper cathode and copper scrap was 1,277 yuan/mt, increasing by 14 yuan/mt MoM. The price difference between copper cathode rod and secondary copper rod was 1,245 yuan/mt. According to an SMM survey, due to the fluctuating trend in copper prices, demand from terminal wire and cable enterprises pulled back again. Some wire and cable enterprises reported poor sales orders. With an increase in finished product inventories, they might temporarily suspend production.

(5) Inventory: On June 18, LME copper cathode inventories decreased by 200 mt to 107,350 mt. On the same day, SHFE warrant inventories decreased by 7,527 mt to 47,014 mt.

Price: On the macro front, the US Fed maintained interest rates unchanged as expected. In its statement, policymakers maintained their expectation of two interest rate cuts this year, but the number of officials expecting no rate cuts this year increased. Next year's rate cut expectations were reduced to one. Powell continued to emphasize uncertainties and predicted "high inflation" in the coming months. The US dollar index rose, exerting bearish pressure on copper prices. On the fundamental front, spot premiums for copper cathode fluctuated significantly, with notable differences among brands. Yesterday, suppliers, concerned about subsequent warrant outflows, rushed to sell, while Russian copper was also sold at low prices, impacting the market. It is expected that there will still be downside room for premiums after today's warrant outflows. In summary, given the presence of bearish factors, it is expected that copper prices will struggle to continue rising today.

[The information provided is for reference only. This article does not constitute direct investment research or decision-making advice. Clients should make cautious decisions and should not rely on this information to replace their independent judgment. Any decisions made by clients are unrelated to SMM.]